By | Dave Ulrich | Speaker, Author, Professor, Thought Partner on HR, Leadership, and Organization

In today’s world of technological, demographic, global, consumer, and competitive change, managing culture is increasingly central to business success. And yet, in many decades of research, consulting, and executive teaching, my colleagues and I have rarely found that companies know how to design and implement the “right” organization culture—one that focuses on the requirements of the competitive market place, including ever-changing customer demands.

Why Culture Matters

Individuals can be champions, but teams win championships. Culture makes the whole greater than the parts. Culture is also more difficult to copy than accessing financial capital, implementing a new technology system, or even crafting a strategic plan. Culture ensures sustainability so that organization actions outlive any single individual act. And no, culture does not just eat strategy for breakfast (Peter Drucker’s attributed famous quote); it serves strategy as an on-going diet.

Culture is top-of-mind for CEOs who want to transform their organization, future high-potential employees who are looking for a cultural fit, and even for the Chartered Institute of Auditors who have prepared recent documentation to help auditors monitor culture.[i] Culture is center stage for business success and a priority for HR.

What Culture Means

One challenge in managing culture is that the concept has become a Rorschach test of sorts with many related concepts, terms, and prescriptions depending on how one thinks about organization culture—as resources, core competencies, health, climate, processes, values, beliefs, norms, DNA, shared mindsets, organization types, or systems. With these confusing concepts, no wonder business leaders and HR professionals often have difficulty in creating the “right” culture.

By moving to an outside-in, customer-centric view of culture, leaders can gain cultural clarity by defining the right culture as one that wins in the marketplace. For example, everyone experiences an organization’s culture when we select our preferred restaurant, shop at our favorite store, or stay in a selected hotel. Our customer choices derive in part because we recognize the culture we desire. More generically, in any business setting, customers define the right culture. Thus Southwest Airlines succeeds in part by being known for a low price with a fun experience, Marriott for exceptional service, Apple for design and simplicity, and Google for innovation.

In the above (and many other) examples, the company’s ideal (right or winning) culture is defined by its desired external firm brand (or identity for preferred customers) that is then infused throughout the company. For business leaders or HR professionals to fully leverage culture, they ensure that people feel, think, and act consistently with promises they make to customers and other key stakeholders. As cultural stewards, HR professionals need to have an outside-in perspective where they ensure the internal culture ( and the HR processes through which the ideal culture is created and sustained)directly reflect the external brand promise.

Importance of the Right Culture in the Merger and Acquisition Setting

An outside-in, customer-centric view of culture becomes a critical predictor of the success of a merger and acquisition (M&A). We have seen three evolutionary phases of culture in M&A activity.

Phase 1: Pre 1995: Cultural Ignorance

Often in this time period, M&A specialists would look for an economic fit (M&A saves money by reducing redundancies) and a strategic fit (product or service complementarity). The M&A would go forward only to run into cultural headwinds when the two firms came together. These M&A efforts had about a 20 to 30 percent success rate, success defined as returning cost of capital for the investment in the five ensuing years.

Phase 2: 1995–2015: Cultural Integration

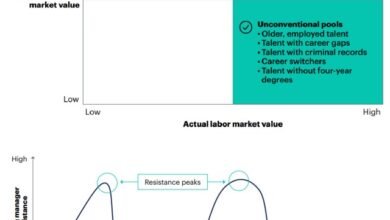

In this phase, culture was considered before the M&A to make sure that the two cultures fit or to anticipate the price (time and money) to integrate the cultures. Often this cultural integration would occur by finding common values and making the common values in the two separate firms a common value for the newly merged firm (see figure 1). Note the focus for the newly formed company (C) is to discover common values and to emphasize them.

The good news with this approach is an awareness of culture (considered before the merger), the overlap of the two cultures (before the merger), and the pathway for the culture of the new company (after the merger).

Being aware of and trying to integrate culture as part of a merger improves success to about 45 to 55 percent.

Phase 3: 2015 and Beyond: Right Cultural Innovation

In Phase 2, the culture focus was on common values looking backward. In Phase 3, the outside-in, customer-centric view of culture focuses on the future. While each firm comes to the M&A setting with a set of cultural values based on their past, the newly created firm should use a clean sheet of paper to innovate the right culture for the new firm.

When culture formation starts by being clear about the desired brand identity in the mind of key customers and investors that is then made real inside the organization, the right culture is created (see figure 2). Note that in this figure, the “new” culture may include some unique cultural elements from either firm A or firm B (values B and I), common values from both firms (value E), and unique values based on customer brand promises (value K).

Our experience shows that this outside-in, customer-centric cultural innovation approach will be a dramatic improvement for M&A success, up to 70 to 80 percent of the time.

Conclusion

Culture matters most and supports the success of an organization when it is not random but tied to customer promises. This outside-in, customer-centric culture particularly needful to increase success in M&A situations.

Republished with permission and originally published at Dave Ulrich’s LinkedIn