By | Luke K Sutherland

Although the country is well on its way to recovery from the effects of the pandemic that might not be the case when it comes to your subordinates’ finances. VeryWellMind conducted a survey in which 33% of respondents reported that COVID-19 had a moderate to extreme impact on their source of income. Between April and July 2021, it lowered by only 1%, despite other COVID stressors diminishing by 5% to 6% across the board. That said, their worries about their financial situation actually affect their well-being and performance much more than you think; here’s how:

The Impact of Financial Stress

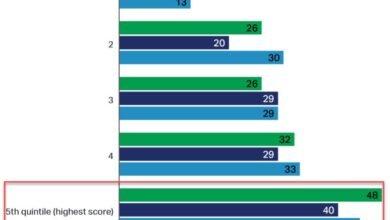

Financial stress often snags the number 1 spot in stress surveys (73%), followed by politics (59%), work (49%), and family (46%) — ranking higher than work stress in itself says a lot about its impact on employees. In a study published in journal site Science Direct, researchers found that financial safety and physical and mental health are positively associated. Stress resulting from financial challenges is often chronic and can manifest through symptoms such as anxiety, headaches or migraines, compromised immune systems, digestive issues, depression, among others.

Worse, those who already struggle to make ends meet will choose to endure their ailments instead of seeking medical help. Low wages have also been found to predict a higher prevalence of absenteeism, decreased performance, and even lower cognitive functioning. It can cause employees to miss almost twice as many workdays each year compared to their financially stable peers. Worse, continued absenteeism can lead to a turnover increase.

Lastly, financial stress negatively impacts performance and productivity, and in a way limits their motivation, energy, and focus. According to statistics from the APA, low salaries (56%) on top of heavy workloads (50%) and unrealistic expectations (48%) cause employees to consider leaving their jobs. Moreover, worrying about money makes mental health worse, and poorer mental health makes managing and earning money a lot harder. It’s a cyclical problem that employees struggle with, and an urgent problem employers need to address.

Helping Employees Become Financially Resilient

Progressive business leaders have been providing financial wellness benefits for their employees in recent years. This comes in an array of categories of financial literacy. Trusted finance website AskMoney explains how improving your employees’ financial literacy can be a great long-term investment. This allows them to get better at budgeting, investing, and managing their debt.

And while pensions have long been the focus when it comes to employee financial well being, providing support for your employees to help them achieve their healthcare, housing, and education goals for their families will greatly improve their way of life and encourage them to perform better at work. This can be done through financial management tools, planning, and even wage advances.

As mentioned in our ‘How Putting Your Employees First Improves Business Success’ feature, prioritizing your employees is good for your business. They aren’t simply cogs in a machine; they are driven by multifaceted desires. The more stable they are with their finances, the more chances they have of reaching their goals. Moreover, happier employees equal increased productivity, efficiency, and company loyalty.

Visit us at Human Engineers to learn more about resources management, human resources development, and business strategies.